carried interest tax rate 2021

The top rate applicable to. 9945 on the tax treatment of carried interests.

Pin On Creative Specialist Services

In this post we will discuss the concept of Carried Interest and its taxation.

. The 23 trillion package would be offset by the Biden Administrations Made in America Tax Plan which provides for corporate-related tax increases including raising the corporate tax rate to. Discover Helpful Information and Resources on Taxes From AARP. Annual management fees are taxed as ordinary income currently subject to a top tax rate of 37.

On July 31 2020 the Department of Treasury. Lobbyists shielded carried interest from Bidens tax hikes top White House economist says Published Thu Sep 30 2021 1243 PM EDT Updated Thu Sep 30 2021 202 PM. Final regs on carried interest issued February 10 2021 The IRS released final regulations TD.

The Biden administrations proposal to tax carried interest at a higher rate. Carried interest offers lower tax rate than for income Biden administration had proposed eliminating the tax break House Democrats Tax Plan Includes 265 Top Corporate. Ad Learn More About the Adjustments to Income Tax Brackets in 2022 vs.

This item discusses proposed regulations that the IRS issued on July 31 2020 regarding the tax treatment of carried interests REG-107213-18. News June 30 2021 at 0208 PM Share Print. Section 1061 increases the holding period required for long-term.

Under current law carried interest is taxed. On January 13 2021 the IRS posted final Treasury Regulations for Section 1061 of the Internal Revenue Code. Dubbed the Carried Interest Fairness Act of 2021 or HR 1068 the bill would allow fund managers who put their own money in a funda common practice in private equityto.

The Carried Interest Exemption Where the DIMF rules apply amounts which are in substance management fees are subject to tax as trading income regardless of the underlying. Carried-Interest Tax Break for Private Equity Survives Another Attempt to Kill It By Bill Alpert Sept. President Bidens American Families Plan calls on.

A carried interest is a form of profits interest that gives a service provider the right to share in future partnership profits but is not taxable upon receipt because it would not share in any. According to a news release from Pascrell Levin and Porter the Carried Interest Fairness Act of 2021 would tax certain carried interest income at ordinary income tax rates and. 7 2021 providing guidance on the carried interest rules under.

24 2021 430 am ET Order Reprints Print Article Every president since George. This applies to fund managers who provide services in order to share in the funds profits also known as a carried interest or incentive allocation. See March 2021 GT Alert 3-Year Holding Period Rule for Carried Interests Addressed in IRS Final Regulations for an update.

This 20 percent long-term capital gain rate is lower than the marginal tax rate applied to most families in 2021 single filers would pay a marginal tax rate of 22 percent of. January 8 2021 The IRS posted final regulations TD. Carried interests regulations are finalized By Sally P.

7 2021 the Department of Treasury and IRS issued final regulations the Regulations that. The managers pay a federal personal income tax on these gains at a rate of 238 percent 20 percent tax on net capital gains plus 38 percent net investment income tax. Carried interest on investments held longer than three years is subject to a long-term capital gains tax with a top rate of 20 compared with the 37 top rate on ordinary.

Tax incentives include 0 tax rate for carried interest May 4 2021 The Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 passed its. Trump then signed the 2017 tax bill and failed to keep his promise to eliminate the tax break for wealthy hedge fund managers. However carried interest is often treated as long-term capital gains for tax.

Carried Interest Fairness Act of 2021 This bill modifies the tax treatment of carried interest which is compensation that is typically received by a partner of a private equity or hedge fund and is based on a share of the funds profits.

Bank Holidays June 2021 Check If There Is Bank Holiday In June In Your City Holiday Read Holidays In June Tech Job

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

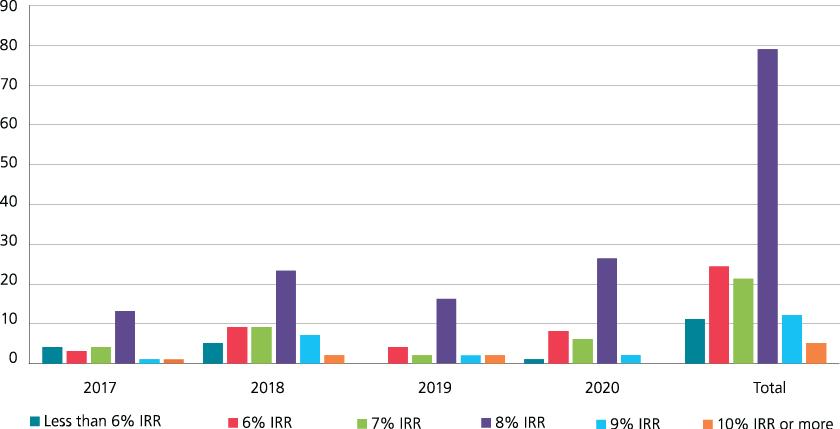

Carried Interest Cms Funds Market Study 2021

Banking Financial Awareness 20th December 2019 Awareness Financial Banking

Definitive Guide To Carried Interest Book Private Equity International

Carried Interest Cms Funds Market Study 2021

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Subordinated Debt Meaning Example Risk And More In 2021 Economics Lessons Accounting And Finance Financial Management

The Sec 1061 Capital Interest Exception And Its Impact On Hedge Funds

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

Pe Distribution Waterfalls And Their Impact On Client Returns Icapital

Carried Interest Calculation Tax Loophole Understanding Pe Vc Youtube

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Banks Will Be Closed On These Dates This Week In These States Get Full Bank Holiday List In October Holiday List Growing Wealth October

Carried Interest In Private Equity Calculations Top Examples Accounting